Need, not luxury: Experts say the tax on feminine products penalizes women

Photo by Lauren Patrick

“And to tax something that is a physiological need is to treat females’ biological needs as not fundamental physiological needs.”

November 19, 2019

Luxury is usually an idea associated with pleasure or comfort. Something not absolutely necessary. Something that you have no need for. Something that you can live without. One thing it’s not usually associated with is a tampon.

As in the majority of states, in Indiana feminine products are assessed at the usual sales tax rate. In Indiana, that’s 7 percent. This is different than other health items because feminine products fall under the category of luxury products. In comparison, some other items that are considered essential, and therefore face no sales tax, are health care items like lip balms, bandages, and condoms.

According to Maria Bucur, professor of Gender Studies at Indiana University, the luxury tax is placed on feminine products because of “the notion that something that isn’t a health product, fundamentally, is regarded as a luxury non-necessity.”

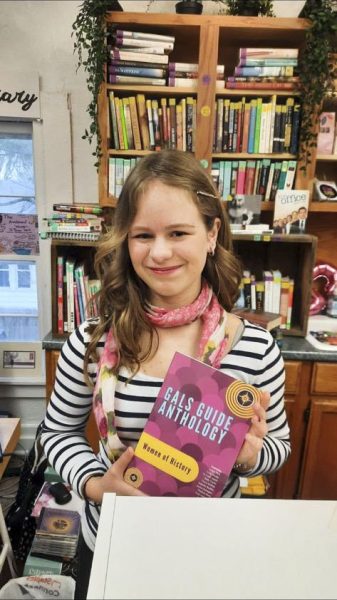

Despite the seriousness of this situation, many consumers are unfamiliar with the luxury tax on feminine products. Junior Hayley Lester wasn’t aware of the tax until recently, but wasn’t surprised by it.

“Personally, I’m not that shocked,” Lester said. “I feel like they know this is something that is going to get bought, regardless of what it is, so they tax it, because they know they’ll make money off it.”

In Indiana, several similar items are taxed in the luxury category, including items that Bucur describes as necessary for life.

“To tax something as a luxury, that would be comparable to things like alcohol consumption or cigarette consumption, which are not necessities but are very much consumer choices,” Bucur said. “And to tax something that is a physiological need is to treat females’ biological needs as not fundamental physiological needs.”

Bucur notes that women between the developmental stages of puberty and menopause purchase approximately thirty to forty years worth of feminine products on a monthly basis. She points out that menstruation is not a voluntary process. It’s not something that women choose to participate in, she says and it’s not an experience that most women would consider to be a luxury. Feminine products are a biological need, and taxing them is treating them as if they are not, according to Bucur.

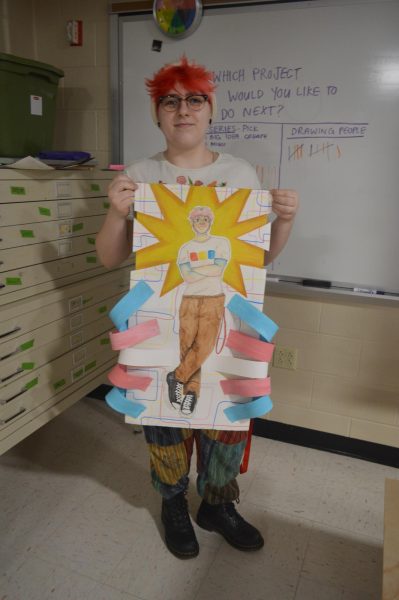

Some students at NHS support Bucur’s analysis. Sophomore Brett Lush, despite not being directly impacted by the tax himself, is aware of the tax’s sexist nature.

“I think that [the tax] is kind of dumb, because why can’t girls get what they need, without having to pay extra?” Lush said.

Lester feels the same disappointment with the tax as Lush does.

“When buying these feminine products that we literally need, having an extra tax on that is kind of unacceptable,” Lester said.

However, this tax affects more than the typical middle class consumer. Anyone who has a menstrual cycle has to deal with the consequences. And for some people facing harsh living conditions, where money is tight and priorities must be decided, Bucur points out that the tax can have more of an impact than just a few extra coins out of the wallet.

“Individuals have to make very tough choices along many other lines of expenditures that they have to make on a monthly basis, such as feeding their families, paying for utilities,” Bucur said. “And this might not be a huge expense on a one time basis, but because necessity purchases are recurring monthly expenditures, it really adds up to a substantial amount of money over time.”

Nancy Chance has worked with homeless communities in central Indiana throughout her life, and she notices the tax has an impact on those families.

“It affects the low end, socioeconomic group in our county who struggle to make ends meet from day to day. It’s just impacting their budget one more time,” Chance said.

In the end, though, Bucur believes the problem comes down to the sexist nature of the tax, a policy created to take advantage of women’s biological needs. Needs that Bucur believes would be rightfully acknowledged if the men of this world had periods.

“If men were menstruating,” Bucur said, “this issue would have been solved decades ago.”

The Impact

The luxury tax has an impact on everyone who has a menstrual cycle, but the tax is felt more significantly by people struggling economically in today’s society.

Nancy Chance, an advocate for the homeless population in Hamilton County, says the tax is especially tough on homeless women.

“There are people who can afford to take that 6 or 7 percent. And there are people who can’t, and the ones who can’t are on the lower end of society, struggling to make ends meet,” Chance said.

Alongside the financial burden that comes with the tax, Chance brings up a potentially bigger issue that pertains to women’s health.

“I think it’s going to be harder and harder for them to get products. And they resort to using inappropriate items like rags and fabrics instead of something that has more potential to be safer and more hygienic,” Chance said.

Without access to safer products, Chance says, women who are homeless can face disease and infections.

Chance says that many homeless women and women in difficult financial situations women don’t buy their needed products themselves. Instead they go to their local food pantry.

“A lot of times they don’t always buy things, they get it in the pantry. And what will happen is the pantries are going to either have to pay more for it or ask for more donations,” Nancy said. “And if things are more expensive, people donate less, so you’re gonna have a harder time getting more products in because they’re having to pay more for products and it’s going to be harder for people to buy more.”

Chance describes the overall impact of the tax on the homeless population simply.

“It affects the socioeconomic group in our county who struggle to make ends meet from day to day,” Chance said. “It’s just impacting their budget one more time.”